End of April 2025 Portfolio Review

Here's a review of developments on our stocks over the past month. We will provide a performance review in a separate article.

Ascent Industries (ACNT)

Ascent has two business segments: tubular pipes and specialty chemicals. The company introduced a new management team in 2023, bringing an extensive and successful background in specialty chemicals. The new management team is transitioning the company to focus on higher-margin specialty chemicals and has initiated the divestiture of its tubular operations.

The chemicals division produces specialty chemicals for various industries, including carpet, chemical, paper, metals, mining, agricultural, fiber, paint, textile, automotive, petroleum, cosmetics, mattress, furniture, and janitorial. Generally, the company serves blue-chip customers in chemical processes that are specific and not scalable, making them too small revenue-wise for the larger specialty chemical companies, but result in sticky recurring revenue like contracts.

Activist investors recognized the value in an underperforming company and took control of the board in 2023, appointing industry veteran Brian Kitchen as interim CEO. Mr. Kitchen is now the permanent CEO, and he has brought on his team members from previous successful exits, including CFO Ryan Kavalauskas.

The new management team harvested low-hanging fruit opportunities, improved profit margins, and cleaned the balance sheet by reducing debt. The Bristol Metals sale in March brought in $45 M. The yet-to-be-accomplished American Stainless Tubing asset will soon complete the product shift to 100% specialty chemical products. The company now has over $60 M in cash on the balance sheet, and no debt.

The management team is now focused on scaling its specialty chemicals business. Last week, the company announced the acquisition of a specialty chemicals company. The acquired company serves an existing Ascent customer and will increase specialty chemical product sales by 10%.

The American Stainless Tubing asset sale is expected to be completed before the end of the year. It will further boost the strong balance sheet, resulting in a profitable chemicals business selling below 1X sales. Ascent is also a play on the tariff climate, as almost all sourcing and manufacturing is completed in the U.S.

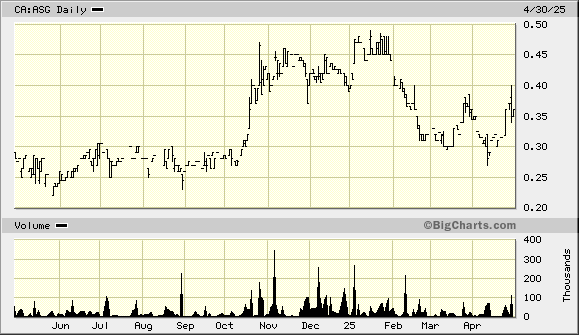

Aurora Spine - ASG.V ASAPF

Aurora Spine is a company specializing in minimally invasive spine devices. Its sales are almost 100% organic, and its products are FDA-cleared. As the minimally invasive spine surgery industry is still in its early stages, there is considerable market share to be gained.

Over the past few months, the company has strengthened its in-house sales force to drive revenue growth and profitability, while it continues to add new products, giving surgeons more of a one-stop shopping opportunity. The company will commence commercial sales of its recently FDA-cleared Aero facet device this quarter. Notably, the device was cleared for cervical to lumbar, allowing Aurora to introduce the implant for the entire spine. No other company has gained such clearance from the FDA. Aurora plans to begin with lumber and work its way up from there.

Aurora supplies the installation kits for its devices. These kits are expensive, and there are also the transportation costs of rotating them to where they will be utilized. The Aero introduction presents a higher profit margin opportunity as the company is experimenting with disposable installation kits for these devices.

The company reported fiscal 2024 earnings yesterday. Profitability was missed as spending for doctor training and additional sales staff was added, setting up expectations for record revenue and profitability in 2025.

Cardiol Therapeutics - CRDL

Cardiol Therapeutics is a clinical-stage life sciences company focused on anti-inflammatory therapies for heart disease. The company's lead drug, CardiolRx™ for treating Pericarditis and Myocarditis, is a THC-free (<10 ppm) pharmaceutically produced ultra-pure, high-concentration cannabidiol oral formulation manufactured under Good Manufacturing Practices.

The stock price has declined since June as investors were confused by mid-stage data released for treating pericarditis. News releases cited the results as mixed. The data was instrumental in continuing the clinical trial with the most effective dosage and eliminating dosages with weaker outcomes.

The company is currently enrolling patients in a MAVEriC Phase III trial. Results from the trial are expected in mid-2026, and if cleared by the FDA, commercial rollout is anticipated to commence late in 2026 or early 2027.

Other near-term potential share price appreciation catalysts are:

Top-line data from the myocarditis FDA Phase II ARCHER trial for CardiolRx in early Q2,

The company has exclusive rights to its pipeline drugs and is likely negotiating with large pharmaceutical companies for hundreds of millions of dollars in commercial partnerships. This is another potential catalyst for share price appreciation.

The five analysts offering coverage on Cardiol recognize the potential upside for the stock, with price targets ranging from $6 to $10 per share.

Check out our recent article on this stock, where we update the original investment thesis and highlight the potential price appreciation catalysts.

CSP Inc. - CSPI

CSP Inc. provides IT, cloud, security, and computer system products and services. We have been bullish on this stock since the introduction of Aria Zero Trust Protect in July 2023. AZT is designed to prevent a malicious attack before it can enter a computer. It requires no downtime to install, and the software is operating system-agnostic.

AZT doesn't seek to prevent malware from entering a system; instead, it only allows authorized entry. It may sound too simple to be accurate, but AZT has won multiple awards. The company has bulked up its distribution network and has the potential to be a game-changer.

The 2025 Q1 report, released in February, included some significant data. The underlying legacy business had increased revenue despite discontinuing lower-margin business activity. The balance sheet is robust, with $30 million in cash. Management cited that they are signing contracts with low-hanging fruit for the potential game-changing AZT product, while geared up to capture much larger customers through Rockwell Automation's distribution network.

We are beginning to see AZT sales pick up as two major deals were announced this past month. A large healthcare provider with clinics throughout Florida signed on, and the new reseller partner, Oryx Industries, produced a new contract to provide security for a large tower operator in Africa.

Coya Therapeutics COYA

Coya is a clinical-stage company developing treatments for neurodegenerative diseases, including Amyotrophic Lateral Sclerosis ("ALS"), Alzheimer's disease ("AD"), Parkinson's disease ("PD"), and Frontotemporal Dementia ("FD"). Neurodegenerative diseases destroy brain cells, and the process is irreversible. Currently, available treatments slow the disease's progression, but there is no FDA-approved cure for neurodegenerative diseases. Coya is targeting filling that void.

Coya has partnered with Dr. Reddy Labs to develop and commercialize COYA 302 for ALS, a deal that could be worth up to $700 million if all goals are met. Coya 302 combines Coya 301 and a Dr. Reddy's drug.. The company will receive $8.2 million from Dr. Reddy on initiating the Phase 2 ALS study, which is expected this quarter. Also expected this year is a partnership for developing and commercializing Coya 303, a combination of Coya 301 with GLP-1, for treating ALS.

Other potential catalysts for share price appreciation in 2025 include the following:

Q1 2025: Additional data from the Alzheimer's clinical trial.

Q2 2025: Topline results from the FTD study.

Q2 2025: Submission of additional nonclinical data to support the start of the COYA-302 Phase 2 trial in patients with ALS

Upon IND acceptance and first patient dosing of COYA-302 in ALS, eligible to receive milestone payments of $8.4 million from strategic partner, Dr. Reddy’s Laboratories (DRL)

Q2 2025: Publication of COYA-303 combination mechanistic data

Q2 2025: Publication of data documenting the role of inflammation in Parkinson’s Disease

Q2 2025: ALS Biomarker data. Publication of longitudinal data on Neurofilament Light Chain and oxidative stress markers in patients with ALS

2H 2025: Additional single-cell proteomics data from the completed investigator-initiated, 21-week, double-blind, placebo-controlled, exploratory Phase 2 study of low-dose interleukin-2 (LD IL-2) in patients with Alzheimer’s disease (AD)

2H 2025: Filing of IND for the COYA-302 Phase 2 trial in patients with FTD*

(*Clinical trial initiated upon FDA IND approval)

Delcath Systems DCTH

Delcath, introduced to our portfolio on January 12, is a hybrid medical device company that treats primary and metastatic liver cancer. It is very common for primary cancer from other body organs to metastasize in the liver, as the liver filters out harmful substances from the blood.

The FDA cleared the company's Hepzato Kit in August 2023 for treating metastatic ocular melanoma ("mOM"), an eye cancer that spreads to the liver. This is the first FDA-approved device for treating the entire liver. Delcath intends to develop Hepzato into a platform for treating all types of liver cancer and currently has two Phase II clinical trials in progress.

Delcath is on target to have 30 active medical centers by the end of the year. The average treatment rate per center is two per month, which is expected to increase as each center maximizes its potential.

The stock is expected to be added to the Russell 2000 index in June. That would result in buying about 4 million DCTH shares for the index. That is heavy buying when considering that only about 33 million shares are outstanding, and only half of the outstanding shares are available for public trading.

Frequency Electronics - FEIM

Frequency Electronics designs, develops, and manufactures precision time and frequency generation technology for satellites and secure terrestrial communication, command, and control. The majority of revenue is derived from U.S. government contracts.

The company is the world leader in precision time and frequency generation technology. The satellite industry is undergoing a paradigm shift, and Frequency is successfully leveraging its technological superiority while adapting to this changing industry. The secret sauce for the company's success has been continued strong sales from established products, combined with the addition of new products.

The company reported 2025 Q3 results during March. The reported revenue of $ 49.8 M for the nine months, compared to $39.7 M in the prior year, is the highest in ten years. The backlog remained high at $73 M, slightly lower than the $78 M for the previous fiscal year. The balance sheet is solid, with $27 M in working capital and no debt.

Following the earnings report, Frequency announced a $12 million contract to deliver synchronization products over the next three years.

Gossamer Bio - GOSS

Gossamer Bio is a clinical-stage biopharmaceutical company with a single drug pipeline: Seralutinib. Seralutinib is focused on treating pulmonary arterial hypertension ("PAH") and pulmonary hypertension with interstitial lung disease ("PH-ILD").

The company is currently enrolling patients for a phase III Prosera clinical trial, with improvement in 6MWD as the primary endpoint. Gossamer has partnered with a large pharmaceutical company and strengthened its leadership team to expedite the completion of the regulatory process and the anticipated commercial rollout.

Top-line results for the Prosera Phase III PAH clinical trial are expected in Q4 2025. Smaller potential catalysts, such as the introduction of Seralutinib to the medical community and analysts' estimates revisions, also exist. The company had $295 million in cash as of the end of 2024 to fund operations for the next two years or more.

Kneat - KSIOF KSI.V

Kneat is a first mover in digitalizing validation and quality management compliance. The company continues to add new customers and is pushing toward profitability. Contracts start small and grow into values exceeding $1 million annually within two years. Since contracts with smaller companies won't significantly impact overall earnings for two years, these deals are typically announced on social media platforms, such as X. Contracts with larger companies are disclosed through press releases. Kneat is signing major deals almost monthly. In April, a new major pharma customer was announced.

The stock trades at expensive multiples relative to its peer group, but these multiples do not account for the land-and-expand nature of Kneat's business model. The stock is becoming more attractive as profitability is now within reach.

Looking for news from the company's Validate event, which is taking place this week.

Kraken Robotics - KRKNF PING.V

Kraken Robotics is an underwater technology company that provides imaging sensors, batteries, and subsea robots primarily for the defense and offshore energy industries. Kraken is a first mover in unmanned underwater vehicles ("UUVs") equipped with synthetic aperture sonar ("SAS")and is the only pure-play related to UUVs that I could find.

The stock trades at rich multiples but is widely considered a likely acquisition. Kraken was the top performer on the TSX Venture exchange for 2024, the fourth time the stock has been included in the annual TSX Venture Top 50 list.

Kraken recently announced its most significant battery order and opened a new production facility in Nova Scotia. Besides the monetary size of the order, the company has developed a new LG battery cell pouch that is smaller in size and can fit into vehicles that its legacy batteries can not. These new batteries are cheaper and more powerful. The company also announced the acquisition of 3D At Depth, allowing it to expand its product offerings and establish a U.S.-based footprint.

Management guided 40% growth for 2025.

NTG Clarity (NYWKF) (NCI.V)

NTG was founded in 1992 by Egyptian-born Canadian electronics engineer Ashraf Zaghloul. The company has led the way in providing digital transformation services in the Middle East. It is leveraging its long history of conducting business in the region to gain market share in the trillions of dollars earmarked by the Saudi Arabian government for its Vision 2030 program. The Saudis are transitioning from economic dependence on oil to developing infrastructure and expanding banking, technology, and manufacturing activities.

The company enjoys a competitive advantage over larger competitors in the Middle East by offering Arabic language IT professionals. NTG offers educational programs in Saudi Arabia and Egypt to train individuals for IT careers, ensuring the company has qualified staffing to meet demand.

NTG is profitable, sells at a modest valuation, and is experiencing explosive growth. Revenues and gross profits for fiscal 2024 were over 100% higher than the previous year. The company is benefiting from an expansion of services utilized by its customers.

The stock is an excellent play on avoiding tariff-related pressure.

NeurAxis - NRXS

The company continues to expand its insurance coverage for the FDA-cleared IB-Stim treatment for irritable bowel syndrome. It has begun a soft commercial rollout for its second FDA-cleared medical device.

Management has cited that a leading medical journal would name the IB-Stim as the standard of care. The news was initially expected in January and has not yet occurred. Inclusion as the standard of care will validate the device for widespread insurance reimbursement coverage. The IB-Stim will likely receive FDA clearance for expanded treatment, pediatric nausea, in May, and we look forward to the upcoming earnings report. We are forecasting 40% year-over-year revenue growth and triple-digit revenue growth for 2025.

Revenues and profitability can potentially explode higher when the category 1 code for IB-Stim kicks in in January. This is a period when the company sets the stage for share price appreciation by educating doctors and establishing insurance reimbursement coverage with additional insurers.

Nexalin Technologies (NXL)

Nexalin Technology is a clinical-stage company developing neurostimulation devices for treating insomnia, depression, PTSD, Alzheimer's, and other neurological disorders. Nexalin's secret sauce is its patented proprietary high-frequency waveform technology, which is powerful enough to reach the innermost reaches of the brain without causing the patient suffering side effects. Nexalin's technology is called Deep Intracranial Frequency Stimulation ("DIFS"), a minimally invasive form of Deep Brain Stimulation ("DBS").

DIFS has the potential to fill a void in available treatment for brain disorders. Clinical trials have validated the technology, and commercial activity has begun in China. FDA clearance for the virtual treatment of insomnia is targeted for 2026, and the company has a partnership to develop its technology for the in-theater treatment of military personnel.

TAT Technologies TATT

TAT provides thermal, auxiliary power units (APUs), and landing gear solutions to the original equipment manufacturers (OEMs) of commercial and military aviation, as well as to the maintenance, repair, and overhaul (MRO) industries. The company is based in Israel, but most of its work is performed in the United States.

Our investment thesis is that TAT benefits from the strong demand for its products driven by supply chain disruptions. Aviation supply chain issues have led to shortages of airplanes. As the fulfillment of new airplane orders takes at least six years, it will take years for supply to catch up with demand. The lack of new airplanes to meet demand results in the extended service of existing aircraft and increased demand for airplane components, such as those manufactured by TAT, for at least the next five years.

The company's fourth quarter report was stellar. The secret sauce is that the company has massively stockpiled parts affected by supply chain disruptions to the extent that cash flow from operations was negative ($5.8 million, compared to a positive $2.3 million in 2023). The stockpiling has also allowed the company to avoid tariff complications, at least for now.

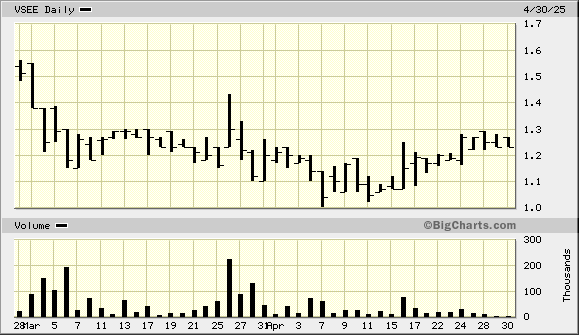

VSEE Health VSEE

Vsee offers customizable telehealth through building blocks that customers do not need to program or code. The Vsee platform also provides highly secure communication and transactions. New contracts announced in January doubled the company's annual revenue, and four contracts were announced in February. In March, the company announced a renewal of a hospital autonomous self-driving robot solution.

The company must raise funds to capitalize on its pipeline orders for hospital groups and federal prisons. Investors are waiting for the expected cap raise to get out of the way before establishing or adding to positions. VSEE is an excellent play on new-generation telehealth and hospital robotics.

WidePoint - WYY

Wide Point offers SaaS services, including identity, mobility, and access management. Its revenue is 80% derived from the U.S. government and 20% from commercial, state, and local customers. Almost all of its revenue is predictable, recurring revenue.

The stock trades at a steep discount to its peer group due to lower margins, as a significant portion of its revenue is pass-through with zero margins. This masks double-digit revenue growth, positive adjusted EBITDA over the last seven years, and four consecutive quarters of free cash flow.

Expanding government contracts, a new certification, introducing a new product, and a new strategic partnership are potential catalysts for the stock to re-rate.

The company reported over 30% revenue growth as it pushes closer to its target of reaching profitability this year. The company's largest customer is Homeland Security, with a contract renewal in November. The new DHS contract is expected to be much larger in value and term than the present contract.

The company benefits from aligning with DOGE's objective, as we discussed in a recent article.